Arguably, the introduction of money as part of society has made life more complicated. Surely, it was far easier when vegetables could be traded for goods and services. The fascinating book by Yuval Noah Harari, Sapiens, explains how life was simpler before the introduction of money. As we placed more and more importance on money our needs also became more complex. Why is money given so much importance? Why are we working towards the goal of having money at the end of our working life? Does money make us happy?

The second aspect that humans focus on the most in life, is money. We have come to believe that money gives us happiness; our entire lifestyle depends on money. It is ingrained in us from the day we’re born and start to learn what money is. The importance of money is taught to us at a very young age; through parents, school, friends, and society in general. Something as simple as watching an ad on TV and being told that you cannot have it, is reason enough to say to yourself ‘when I grow up, I’ll make enough money to buy that’. I grew up in a low to middle-class Indian household, with my parents having enough to live a comfortable lifestyle but never a lavish one. We had enough money to holiday within India, but never overseas. As a child, the modest life offered me a sense of satisfaction. Never did I think I wanted what someone else had, I simply thought what we had was far better than some of the unfortunate ones living on the streets. I was happy to go to school and have a bike to ride past those who were poor and couldn’t.

Perhaps it isn’t that money brings us happiness, it is that we know that lack of money brings us unhappiness. We see those with less money and see how unfortunate or unsatisfied they are. Perhaps it is us that are more unsatisfied, not them. Perhaps, having less, is actually more? The Hedonic treadmill explains that humans have an equilibrium level of happiness. This means that it doesn’t matter if we have a significant (negative or positive) event in our life, we will return back to this equilibrium at some point, it’s just a matter of when. The constant state of dissatisfaction keeps us in the chase for wanting more money, when it is proven that it doesn’t result directly in happiness. So if we know that there is no ultimate level of happiness, how do we try and achieve contentment with money?

Why do we spend money we don’t have, to buy things we don’t need, to impress people we don’t like? The life humans currently live is based on social hierarchy and we have been made to believe that having more and bigger, is better. We spend half of our time comparing ourselves to people who have more than us and the other half worrying about how others perceive us. Being grateful for what we have rather than ungrateful for the things we don’t, there needs to be some fundamental shifts in our core thinking towards money. I believe the following will help bring about this change.

- Detach happiness from materialistic things. I recently read a book called ‘The Little Book of Lykke – Secrets of the World’s Happiest People’, by Meik Wiking. Meik talks about some incredible (but simple) insights about happiness amongst people from Denmark. He states that we need to lower our expectations on what we feel inside when we have acquired materialistic things. That made me realise how much importance we place on achieving our material goals. If I buy a new house, then I’ll be happy. If I buy the new car, then I’ll be happy, etc. This If/Then scenario leaves us in a constant state of unhappiness. Of course, we can still buy things that our heart desires, but lower your expectations on how it’s going to make you feel once it’s in your possession.

- Remove happiness as a goal. Being in pursuit of happiness doesn’t quite make sense to me. What is it that you’re chasing that will give you happiness in the future? When happiness is a goal in the future, we will never find happiness today, we will always be focused towards happiness in the future. If we can focus on things we have rather than things we don’t have, it is easier to find happiness now. Similarly when we say once I’ll make X amount of money, I’ll be happy. We forget be grateful to have what we have today. It is great to have goals, just that it is equally as important to enjoy the journey to reaching the goals and find happiness every single day.

- No one cares about your success. Well your mum does, but that’s as far as that goes, the rest is for your ego. Of course, when you have enough to buy what you want (and what you don’t want), it feels good, but we get a certain pleasure from people talking about us that feeds our egotistical selves. When you have a purpose beyond success – the why to your existence, you reach a greater sense of fulfilment in life. Making money doesn’t directly equal success, we have all heard of plenty of “successful” individuals that are unsuccessful in feeling satisfied in life.

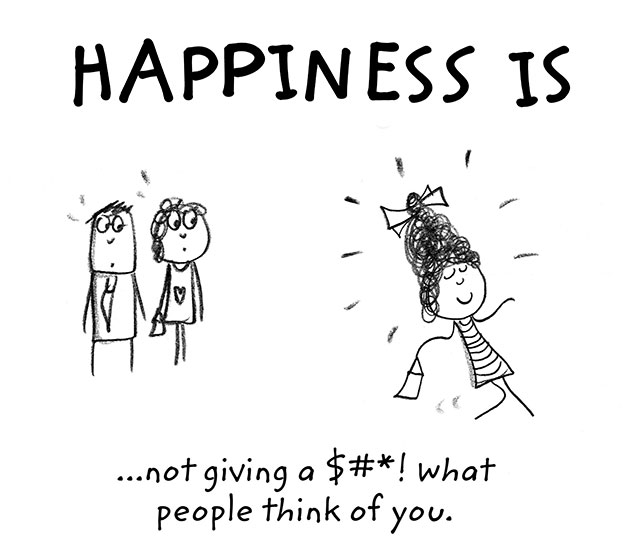

- Focus on yourself, not what others think of you. The role of social media on a personal level is to show how exciting our life is to our friends, because it is important to our ego. That’s why we see so many wishing their wives happy anniversary publicly to show how successful their marriage is, and to make their wives feel good about themselves. Whereas in reality the marriage isn’t going well at all! Personally, I much prefer looking my partner in her eyes and telling her how much she means to me; I have no desire to get confirmation from others about how well I’m doing in my life. How other’s see you is not important in your life, what’s important is how you perceive yourself. The fact that we have to look outside for confirmation is a flawed approach.

- Banish credit from your life. Buying things we couldn’t afford is what the fundamental reason was behind the global financial crisis. If we were smart enough to only own what we could afford, we would be much further ahead than we are today. We often use our credit cards to buy things that we cannot afford today. We convince ourselves, that we can buy this today with money we don’t have and pay it back with money from next month’s salary. Only to realise we had a friends dinner party we needed money for and never end up paying it off.

- Smaller expenses are worse than bigger ones. Just like time, we bleed cash in small amounts that hurt our banks the most. The smaller expenses during the week like a small muffin with a coffee, or quick bite to eat from the café while you’re busy, or drive through breakfast on your way to work; quickly takes its toll on your budget. One coffee a day becomes two and suddenly you’ve spent $50 on coffees for the week. When you’re about to spend small cash on a whim check yourself and think ‘nope, no bleeding cash today’. Do this at least once per day and before you know it, your spending habits will change drastically.

- Find pleasure in saving rather than spending. We all love to spend money because the release of endorphins when we buy what we want keeps us wanting more and more. If we shift our thinking to feel good about the growing bank balance rather than spending it, it alters our brain chemistry to release endorphins to save money instead. I used to find great pleasure in spending money, but ever since I setup an offset account, I now enjoy seeing how much more I saved in interest from the last month.

Money is made to be an essential part of survival for human beings because it determines what type of life we will live. Instead, the thinking needs to be reversed. We need to work out how much money we need to live the life we desire. Let’s try and find our greatest passions in life to make the money we need rather than making as much money as we want doing things we don’t like.